3.4.1Management Board Remuneration Policy

The Company aims at remunerating members of the Management Board for long-term value creation. A remuneration policy is in place that contributes to competitive and aligned remuneration with the long-term performance of SBM Offshore. The current version of the remuneration policy (called RP 2018) has been effective as per January 1, 2018, after approval by the 2018 Annual General Meeting. Full details on the principles and rationale for the RP 2018 are available on SBM Offshore’s website in the Remuneration Policy section under Corporate Governance.

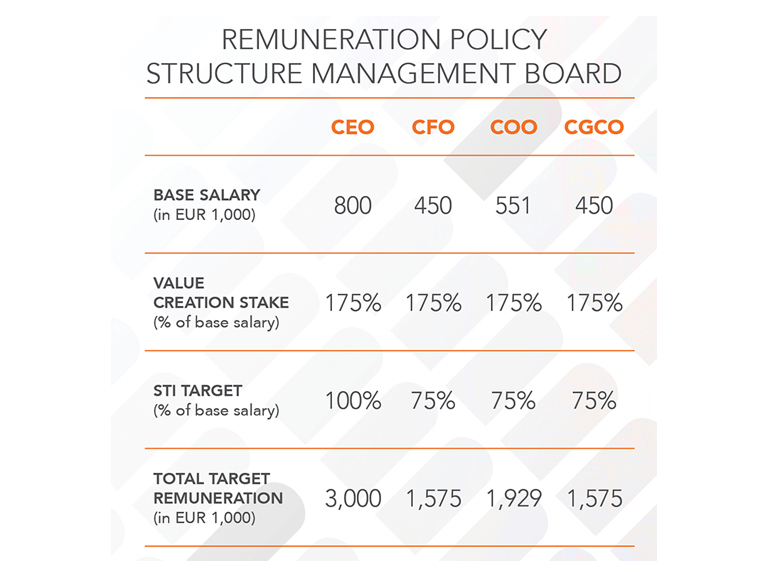

The RP 2018 consists of four components: (1) Base Salary, (2) Short-Term Incentive, (3) Value Creation Stake and (4) Pension and Benefits. These components are explained hereafter.

1. Base salary

The Management Board’s Base Salary is a fixed component paid in cash. The Base Salary levels as set may be adjusted each year within reason, depending on market movements and remuneration adjustments of senior management.

In order to determine a competitive Base Salary level, the Supervisory Board uses the reference group of relevant companies in the industry (hereafter the Reference Group) to determine base salary levels and to monitor total remuneration levels of the Management Board. Base Salaries of the Management Board members and the Reference Group are reviewed annually. In the event any position cannot be benchmarked within the Reference Group, the Supervisory Board may benchmark a position to similar companies.

Current Reference Group1

|

|

|

- 1 Please note that in 2018 WS Atkins plc has been acquired by SNC Lavalin and is therefore no longer part of the Reference Group

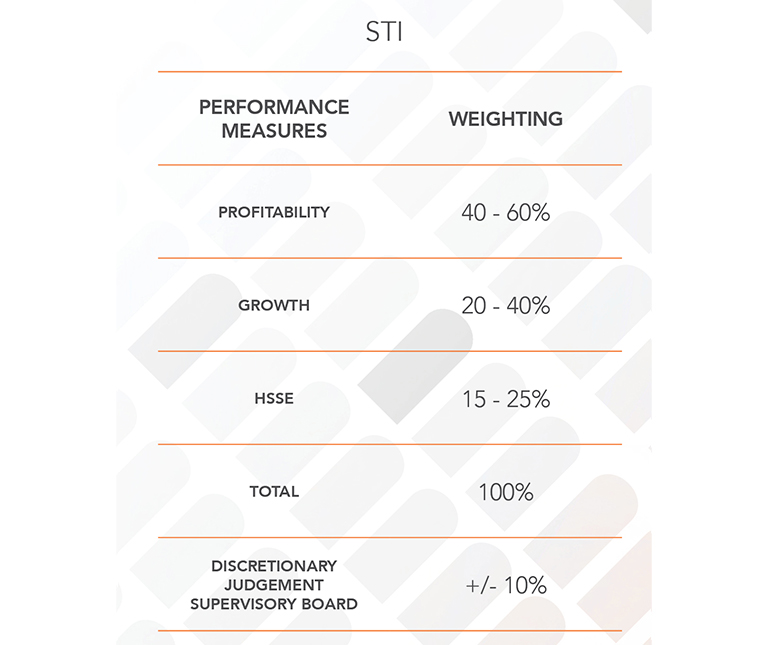

2. Short-Term Incentive

The Short-Term Incentive (STI) is a conditional variable component of the Management Board’s remuneration, paid in cash to create rigorous pay-for-performance relation. The performance measures are focused on three key performance areas: (i) Profitability, (ii) Growth and (iii) Health, Safety, Social and Environment.

The Supervisory Board, at the recommendation of the Appointment and Remuneration Committee (hereafter A&RC), determines the specific performance targets for each of the performance measures in the beginning of the performance year. For each performance indicator, a scenario analysis is performed to determine a threshold, target and maximum level, considering market and investor expectations, as well as the economic environment. At the end of the performance year, the performance is reviewed by the Supervisory Board and the pay-out level is determined. Both the details and the results regarding the performance measures are published in the Remuneration Report following the performance period. As such, the performance indicators applicable in 2018 are mentioned in section 3.4.2 of this report.

The STI is payable in cash after the publication of the annual financial results for the performance year. The STI is set at a target level of 100% of the base salary for the CEO and 75% of the base salary for each of the other Management Board members. The threshold pay-out is at 0.5 times target and maximum pay-out will not exceed 1.5 times target. A linear pay-out line applies between threshold and maximum. Below threshold, the pay-out is zero.

3. Value Creation Stake

The Value Creation Stake is a fixed component paid in restricted shares to create direct alignment with long-term shareholder value. It is an annual award of shares that must be held for at least five years. After retirement or termination, the shares cannot be sold for the duration of two years.

The gross annual grant value for each of the Management Board members is 1.75 times base salary. The number of shares is determined by a four-year average share price (volume-weighted). The Supervisory Board retains the discretion not to award the Value Creation Stake in exceptional market or business circumstances.

All members of the Management Board are required to build up Company stock of at least 3.5 times their gross base salary. The value of the share ownership is determined at the date of grant.

4. Pension and Benefits

The Management Board members are responsible to create their own pension arrangements. In order to facilitate the Management Board members, they receive a pension allowance equal to 25% of their Base Salary.

The Management Board members are entitled to a defined set of emoluments and benefits. A general benefit in this area is the provision of a company car allowance. Other benefits depend on the personal situation of the relevant Management Board members and may include medical and life insurance and a housing allowance.

key elements employment agreements

Each of the Management Board members has entered into a, in principle four year, service contract with the Company, the terms of which have been disclosed in the explanatory notice for the General Meeting of Shareholders at which the Management Board member was appointed.

Adjustment of remuneration and claw-back

The service contracts with the Management Board members contain an adjustment clause giving discretionary authority to the Supervisory Board to adjust upwards or downwards the payment of the STI and LTI (as granted under RP 15), if a lack of adjustment would produce an unfair or unintended result as a consequence of extraordinary circumstances during the period in which the performance criteria have been, or should have been, achieved. In addition, a claw-back provision is included in the services contracts enabling the Company to recover the Value Creation Stake, STI and/ or LTI (as granted under RP 15) on account of incorrect financial data.

Severance Arrangements

The Supervisory Board will determine the appropriate severance payment for Management Board members in accordance with the relevant service contracts and Dutch Corporate Governance Code. The current Dutch Corporate Governance Code provides that the severance payment will not exceed a sum equivalent to one times annual base salary. This also applies in a situation of a change in control.

Loans

SBM Offshore does not provide loans or advances to Management Board members and does not issue guarantees to the benefit of Management Board members.